In order to feel absolutely safe when it comes to your vehicle, whether you’re behind the wheel or at home, DallBogg provides an optimal protection for it.

Discover the pleasure of the trip, we will take care of the rest.

Why should I sign up for a Casco insurance at DallBogg?

By choosing DallBogg for your insurance partner, you get:

- Choice between a list of risks according to your individual needs;

- Possibility for additional discounts;

- Preferential servicing at trusted and official car services.

How and where can I get my DallBogg insurance from?

You can contact us at 0700 16 406 or take advantage of a personal consultation with our specialists. DallBogg also works with a number of contractual partners across the country.

Which is the right Casco package for me?

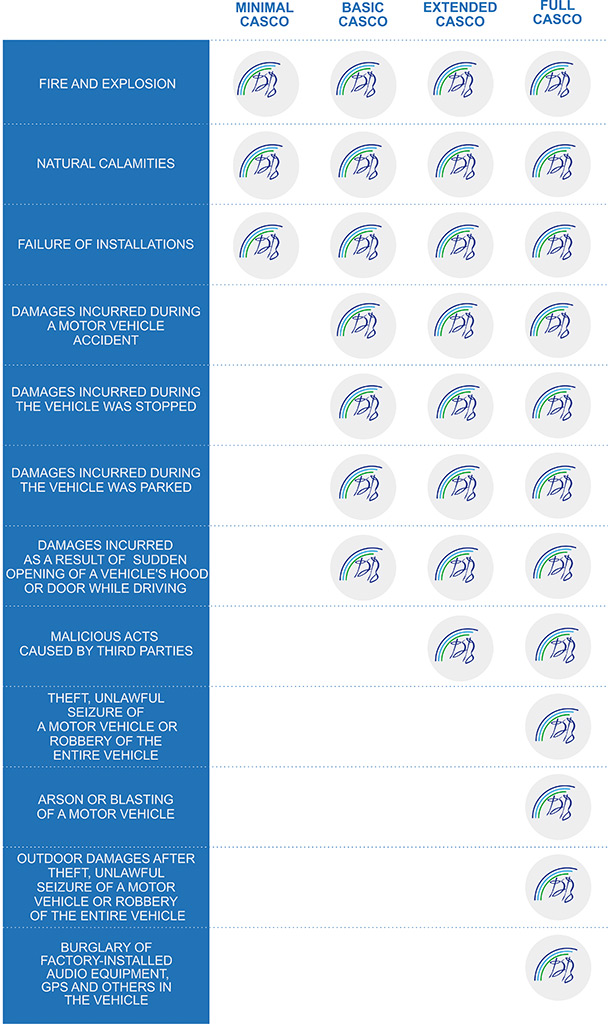

To optimally satisfy your individual needs, DallBogg offers 4 different insurance packages.

Where is the Casco insurance valid?

On the territory of the Republic of Bulgaria, the Member States of the European Union and the European Economic Area as well as the Swiss Confederation, unless otherwise agreed.

What should I do in case of an accident?

Contact us at 0700 16 406 for more information or visit one of our offices.